6% Rate Of Interest*

Unlimited withdrawals

Zero Balance Account

₹ 3.75% Rate Of Interest

Unlimited withdrawals

Zero Balance Account

Financial Stability Starts here: Explore our FIxed deposit Options

Recurring Deposits Can Be An Excellent Savings Tool For Disciplined Investors Who Want To Build Savings Over Time Systematically.

Financial Stability Starts here: Explore our FIxed deposit Options

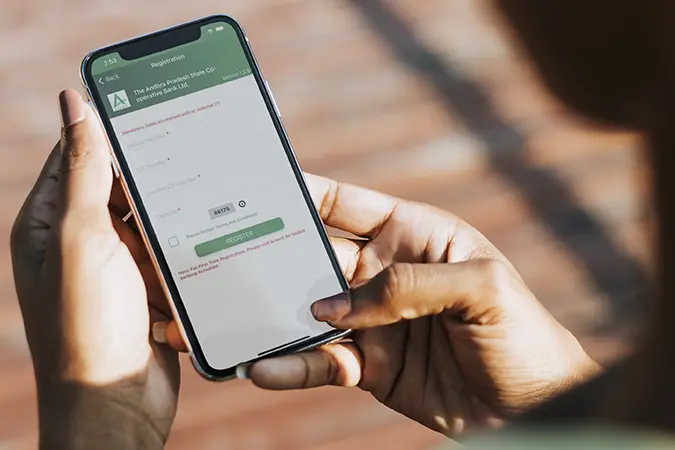

IMPS is an instant interbank electronic fund transfer service available to the customers through Mobile Banking Application.

IMPS is an instant interbank electronic fund transfer service available to the customers through Mobile Banking Application.

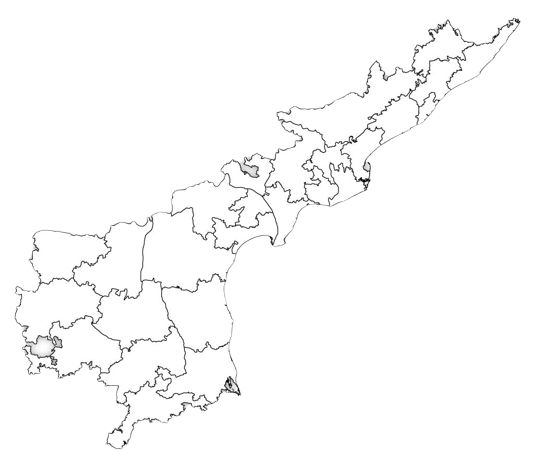

The Andhra Pradesh State Cooperative Bank Limited (APCOB), is a Scheduled State Cooperative Bank in the state of Andhra Pradesh included in the second schedule of the Reserve Bank of India Act., w.e.f. 16th July, 1966 and has been earning profits for the past 60 years and is placed in ‘A’ Category consistently in Audit Classification.

The Bank is committed to agricultural and rural development through cooperatives through trust, integrity and service to the farming community, since its inception on 4th August, 1963 under the Andhra Pradesh Cooperative Societies (APCS) Act, 1949.

Years Of Journey

APCOB has been providing refinance both for Crop loans (Short Term) and Long Term loans for capital investment in agriculture and allied activities to District Co- Operative Central Banks (DCCBs).